The recent release of the 2023 Intergenerational Report projects climate change, together with an ageing population, will become some of the biggest challenges Australia faces over the coming decades.

The latest Intergenerational Report (IGR) argues that population ageing and climate change will be

some of Australia’s biggest challenges. However, there is a way older people can help finance the

transition to a green economy.

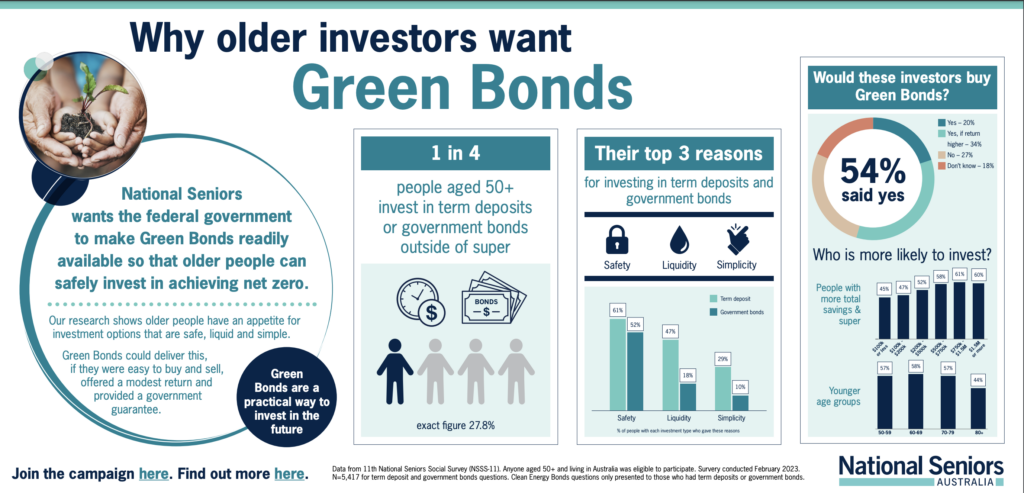

New National Seniors research shows older people want simple and safe ways to invest with many willing to invest in solutions to climate change. It found one in four people aged 50 and older invests in term deposits or government bonds with a majority of these (54 per cent) interested in buying Green Bonds.

“People want simple, safe ways to invest. For most, their only option is government backed term deposits,” Chief Advocate Ian Henschke said. “That’s why National Seniors is calling on the federal government to allow everyday investors to buy the government’s proposed Green Bonds. These bonds will be issued via the ASX in mid-2024 but will be available only to institutional investors.

“Our research shows, tens of thousands of ordinary Australians could contribute billions, if Green

Bonds were readily available to them the way term deposits are.

“The United Kingdom is ahead of us on this.”

To help meet its 2050 emissions target, the UK government has issued Green Savings Bonds for as

little as £100 (approx. $187AUD) or as much as £100,000. The bonds are available via the national

savings bank the NS&I.

Green Savings Bonds now pay an annual interest rate of 5.7 per cent over three years, with the money used to fund environmental projects.

“Like our UK friends, older Australians want to be a part of the solution,” Mr Henschke said.

“Government should make the purchase of its Green Bonds as simple as walking into a Post Office or

a bank, just like the UK.”

National Seniors member, Prof Rob Morrison OAM (former presenter of science program The

Curiosity Show), said he would buy Green Bonds for himself and for his grandchild if they were

available.

“Investing in projects with a positive impact on the environment, is a simple solution to our biggest

challenge. It’s not a radical idea. The UK government is already doing it,” Prof Morrison said.

“It amazes me that Green Bonds are not readily available in Australia given all the blustering from

state and federal governments about the need for us to be a world-leader in green technology.”